Retired gamer

- 42 Posts

- 21 Comments

4·1 year ago

4·1 year agoSorry, don’t have a source on that. Scrolled a million bananas on reddit this year and everything is a blur. :)

I’m assuming DTCC just watches Computershare’s broker for Computershare’s transactions. Doubt they would ever contact Computershare and leave a trail.

4·1 year ago

4·1 year agoCheck out TheUltimator5’s posts on recurring buy fills: https://www.reddit.com/user/theultimator5/

I think 6days1week had the Computershare recurring buy dates marked on a calendar, or maybe TheUltimator5 mentions in one of his posts.

I used the most basic average $1.2 million buy every 2 weeks and used only $14 a share as an example. So 85,714 shares * 6 times a quarter = 514,284 shares from just recurring buys each quarter. Mileage will vary of course on GME share price at the time.

I think the DTCC side can see all broker transactions.

- Computershare’s bi-weekly recurring and daily purchases go through a broker.

- Broker DRS transfers to Computershare notify the DTCC that a stock withdrawal is taking place.

- I think I saw a redditor mention a rule/agreement that the DTCC can ask to see a transfer agent’s books at any time, too.

5·1 year ago

5·1 year agoThe DRS count incrementing 76.0m > 76.26m > 76.6m seems “ok, no ‘major’ f–kery” but still a bit on the low side. Which partly leads to questioning if we are overestimating retail investor purchasing power and how many are DRS-ing in that timeframe.

Without access to the Computershare dashboard to see daily account and count changes, we’re left in the dark guessing. Like the +4.2m for 3/22/2023 versus +.5m on 10/29/2022. One theory is “they” load up DRS accounts, then many months later drain shares to confuse retail.

5·1 year ago

5·1 year agoYeah, I wish the default Lemmy editor included tables like reddit’s Fancy editor. I copy-paste from my reddit post (in Markdown mode) and it preserves the tables over in Lemmy.

5·1 year ago

5·1 year agoThank you, adding inflation for next week’s post.

2·1 year ago

2·1 year agoYeah, the Youtube algorithm is interesting. I get recommended a bunch of AMC, stock market crash, and GME bashing videos sometimes.

Same with Reddit recommendations. I looked at 1 meltdown post maybe 14 months ago, haven’t looked at an AMC post in 2 years, but the algorithm still drums up meltdown and AMC posts on my main page.

5·1 year ago

5·1 year agoI’ve watched Richard Newton’s youtube videos for a while. He’s been very helpful explaining what’s possibly happening via swaps, ETFs, OpEx, cycles, derivatives, etc. Also nice past videos explaining GameStop SEC filings, DRS, GameStop marketplace, former wallet, Loopring, ImmutableX, NFTs, ethereum, crypto, etc.

8·1 year ago

8·1 year agoFurther ruminating, using very conservative numbers.

Not even using 200,000 Computershare accounts. Say just 100,000 accounts.

Is it a stretch to say 100,000 accounts DRS 5 shares a month? 100,000 x 5 shares a month x 3 months = 1,500,000 a quarter

5 shares a month * $22 avg = $110 a month * 3 months = $330 a quarter

Or only 1 to 3 shares a month for 200,000 accounts:

- 1 share a month = 600,000 a quarter

- 2 shares a month = 1,200,000 a quarter

- 3 shares a month = 1,800,000 a quarter

31·1 year ago

31·1 year agoIt seems the underlying question is if the DTCC has any effect on what Computershare provides GameStop for the DRS numbers.

I’m assuming Computershare the transfer agent keeps its own share count and provides the information to GameStop.

- Computershare -> GameStop

Assuming there is no DTCC step where the DTCC tells Computershare what’s on DTCC side, so Computershare has to fudge their numbers to match, then tell GameStop.

Has there been any information that shows the flow of share count data is:

- DTCC -> Computershare -> GameStop

If we include the non-official DRS numbers with the official GameStop SEC filings:

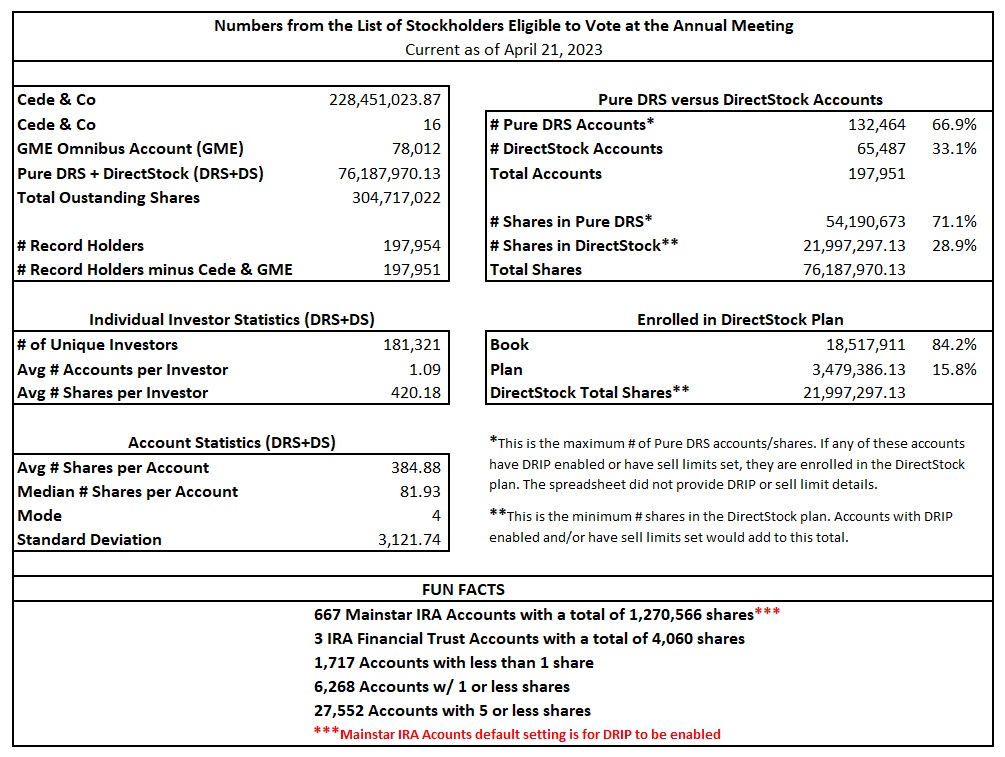

Date DRS in Millions Notes 10/30/21 20.80 SEC filing 01/29/22 35.60 SEC filing 04/30/22 50.80 SEC filing 05/26/22 47.01 List of stockholders 07/30/22 71.30 SEC filing 10/29/22 71.80 SEC filing 03/22/23 76.00 SEC filing 04/21/23 76.26 List of stockholders 06/01/23 76.60 SEC filing 06/20/23 75.33 Mainstar rugpull -1,270,566 08/31/23 75.40 SEC filing The May 2023 visit to GameStop HQ for the 04/21/23 list of stockholders numbers:

Using your numbers:

- 10/29/22 71.80

- 03/22/23 103.2382 - would be like 31.4 million shares times $25 average = $785,000,000

- 06/01/23 114.7828 - like 11.54 million shares times $21 average = $242,340,000

- 08/31/23 129.5794 - like 14.8 million shares times $22 average = $325,600,000

From a dollar amount $1,352,940,000 / 200,000 Computershare accounts = $6,765 each / $22 avg = +308 shares each over 10 months (31 shares a month).

Plausible, but it may be tough for the average holder to spend $676 a month on GME shares. And without the whales buying as much as they initially did, it skews the numbers down too.

3·1 year ago

3·1 year agoWhoops, I think you may be misinterpreting the spreadsheet and graph I put together. I’ll rename the labels some and pick a less “Computershare purple” color in this week’s graph to clarify more.

I wanted to highlight that just 200k Computershare accounts owned 75.5 million DRS shares. And these 200k CS accounts also have a conservative 25% more shares stuck in IRA accounts (not DRS’d). So 75.5 million DRS’d and 18.9 million stuck in IRA accounts. Rather than 85-90 million DRS’d in Computershare.

I was trying to convey that just 200k CS accounts hold 75.5 million DRS and 18.9 million in IRA accounts. And the “remaining 62 million shares” likely doesn’t add up if we think about the total number of retail brokerage, margin, and IRA accounts holding GME.

2·1 year ago

2·1 year agoFrom Richard Newton’s google surveys. I’ll have to go through his recent videos–thought he mentioned 30-50% stuck in IRA accounts, etc but will double check.

2·1 year ago

2·1 year ago- @lawsondt@lemmy.whynotdrs.org 's post near the end explains Insiders Stagnant.

- From Richard Newton’s google surveys. I’ll have to go through his recent videos–thought he mentioned 30-50% stuck in IRA accounts, etc but will double check.

7·2 years ago

7·2 years agoAugust 15, 2023 SS post: https://www.reddit.com/r/Superstonk/comments/15s0c2e/happy_13f_filing_day_apologies_for_quality/ I haven’t gone through the numbers on the screenshots, and I think someone mentioned one page was missing.

Old notes from DRSyourGME:

5/18/2023 numbers from lawsondt’s compilation:

- Outstanding Shares: 304,717,030

- ETFs: 29,268,180

- MFs, Index Funds, Pension Funds, etc.: 35,394,217

- Other Institutional Ownership: 46,228,722

- Insiders: 38,482,026

- Insiders Stagnant: 13,961,696

\

Then 6/13/2023 numbers after known adjustments:

- Outstanding Shares: 304,717,030 -> 304,751,243 Shares outstanding as of June 1, 2023 GameStop Form 10-Q

- ETFs: 29,268,180

- MFs, Index Funds, Pension Funds, etc.: 35,394,217

- Other Institutional Ownership: 46,228,722

- Insiders: 38,482,026 -> +10,000 +5,000 +190,638 +253,204 = 38,985,868

- Insiders Stagnant: 13,961,696

8/15/2023 look again for free float number:

Free float: 304,751,243 - 29,268,180 - 35,394,217 - 46,228,722 - 38,985,868 - 13,961,696 = 140,912,560

8/23/2023 Estimated DRS count: 77,089,291

8/23/2023 Estimated DRS count minus 1,270,566 Mainstar rugpull shares: 75,818,725

6·2 years ago

6·2 years agoThere probably still is “something funny” going on. There is still the unexplained weird jumps up/down in DRS numbers since we first started:

I think we’re still chipping away the last 2 quarters and this coming quarter. Without some whales adding a large chunk this quarter, it looks like averaging around 6,150 DRS a day.

And we had the Mainstar rug pull. Odd timing on that.

And many ETFs containing GME still getting smashed into the dirt with piles of FTDs.

5·2 years ago

5·2 years agoA few redditors have noticed where users do a drsbot reset, their share count goes to 0, then they try to re-add their shares. But then no drsbot witnesses approve their shares. Or the person doesn’t want to go through the approval process again. So we see share count go down like 34,000 or a few thousand shares, but then never get added back.

I manually fixed the #1 whale’s 1.3 million share count. Then this past week started adding back the 34,000+ shares of another whale. I’m too lazy to go through every DRS post looking for discrepancies where smaller amounts of shares don’t get added back. :\

4·2 years ago

4·2 years agoLong ago I had wished they joined forces to create a single DRS counter/scraper. Seems though having multiple DRS counters worked out in the end.

I see jonpro03 made a couple posts/comments since end of May, so I’m sure he’s still lurking. :)

8·2 years ago

8·2 years agoNote that DRSbot’s developer is roid_rage_smurf rather than jonpro03.

Yeah, not sure if Lemmy has API or scripting capabilities to make it easy for DRSbot to tally.

5·2 years ago

5·2 years ago6/5/23 to 6/30/23 - 240,514

7/1/23 to 7/29/23 - 119,783

0·2 years ago

0·2 years agoBecause DRSYourGME got deleted by reddit admins? The choices are pretty limited. Maybe r/GME or r/GMEJungle, but SS is pretty much the goto subreddit still.

Are you me? 😄 I was looking over the 10-Q (again) on Friday night. More of a “How is the stock price down 65% since stock split via dividend when all the SEC filing numbers are better than ever?”

We all know the answer, but I just have to remind myself.